Decentralized Finance (DeFi): Everything You Need to Know

- 0

Decentralized Finance, or DeFi, is a term used to describe financial services that are built on blockchain technology and operate without traditional intermediaries. It enables users to access financial services such as lending, borrowing, trading, and investing in a decentralized manner, without the need for banks or other financial institutions.

How Does DeFi Work?

DeFi works through smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. These smart contracts are deployed on a blockchain, allowing for trustless and automated transactions. Users interact with these smart contracts through decentralized applications (DApps) that run on the blockchain.

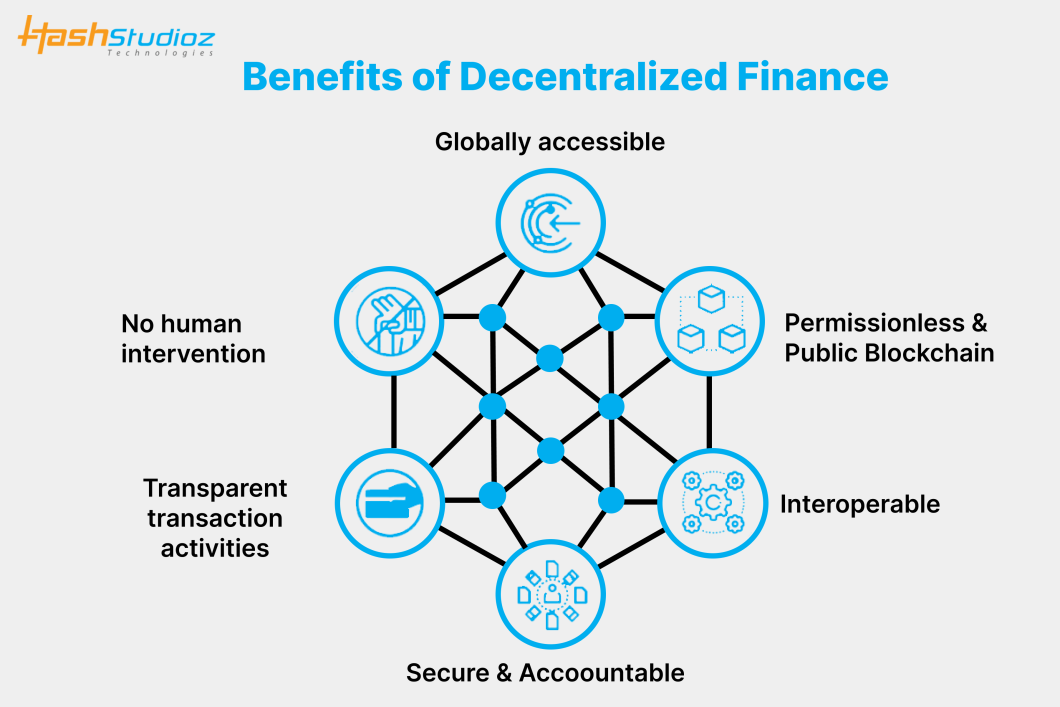

Benefits of DeFi

Decentralization: DeFi eliminates the need for middlemen and gives users direct control over their funds.

Accessibility: DeFi opens up financial services to anyone with an internet connection, regardless of their location or financial status.

Transparency: Since transactions are recorded on a public blockchain, they can be easily verified by anyone.

Security: Funds are stored in smart contracts, reducing the risk of hacks or fraud.

Popular DeFi Platforms

There are several DeFi platforms that offer a wide range of financial services. Some popular platforms include:

Uniswap: A decentralized exchange (DEX) that allows users to trade tokens without the need for a central authority.

Compound: A lending platform that enables users to borrow and lend cryptocurrencies.

MakerDAO: A decentralized autonomous organization (DAO) that issues the stablecoin DAI.

Aave: A lending platform that allows users to earn interest on their cryptocurrency holdings.

Risks of DeFi

While DeFi offers many benefits, it also comes with its own set of risks. Some common risks include:

Smart contract bugs: Since DeFi relies on smart contracts, any vulnerabilities in the code can lead to potential exploits.

Market volatility: The cryptocurrency market is highly volatile, and users can lose their funds if the market crashes.

Regulatory concerns: DeFi platforms operate outside of traditional financial regulations, which can lead to legal issues.

Future of DeFi

The DeFi space is rapidly growing, with new projects and innovations being introduced regularly. As more people become aware of the benefits of DeFi, adoption is expected to increase significantly in the coming years. Traditional financial institutions are also starting to take notice of DeFi and may look to incorporate some of its principles into their own services.

Conclusion

Decentralized Finance (DeFi) offers a revolutionary way to access financial services in a decentralized and transparent manner. While there are risks associated with DeFi, the benefits it provides are significant, and the future of DeFi looks bright. As the space continues to evolve, it will be exciting to see how DeFi transforms the traditional financial industry.